Business Tax Deadline 2021 Tn

Ranked in 2021 part of Best Law Schools. As the most influential business aviation trade show in the United States the 2021 NBAA Business Aviation Convention Exhibition NBAA-BACE is the perfect venue to strengthen your brands recognition in the industry and gain access to decision-makers and buyers of.

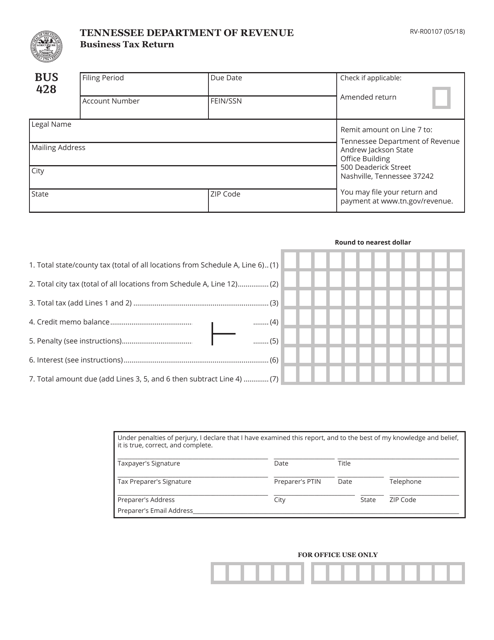

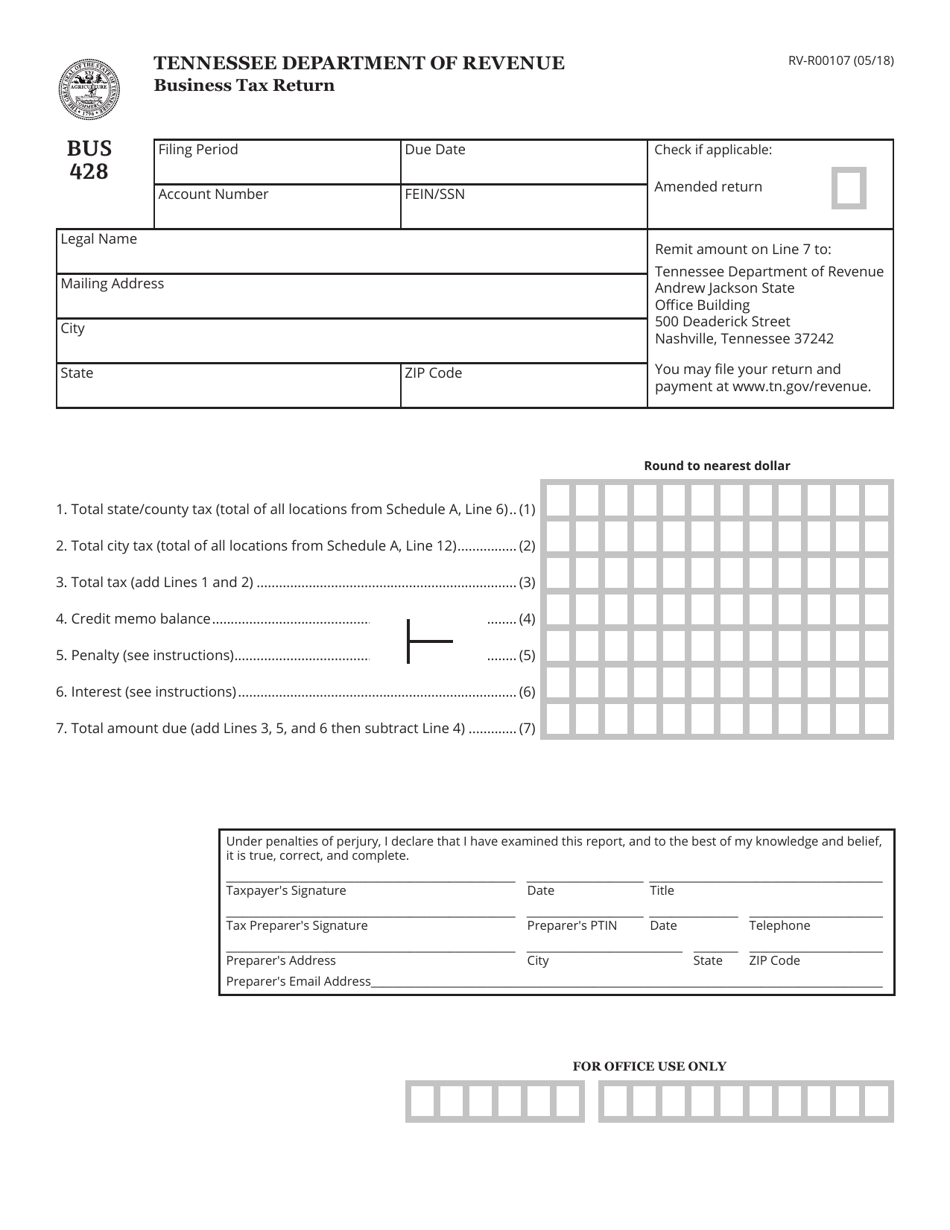

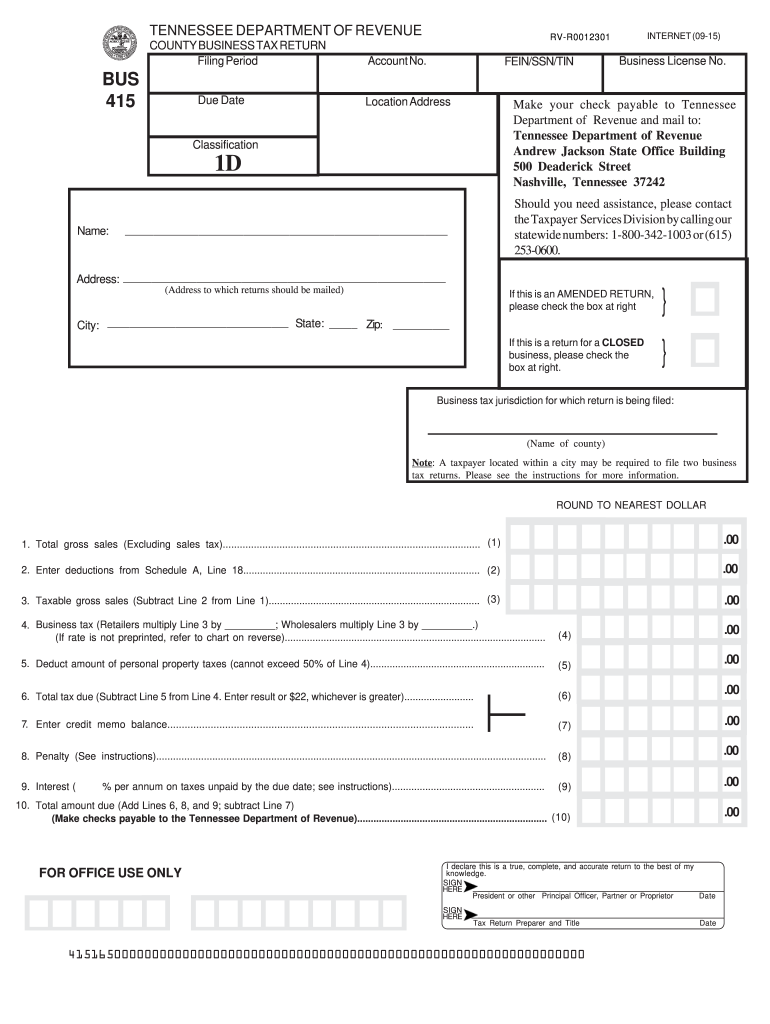

Form Bus428 Rv R00107 Download Printable Pdf Or Fill Online Business Tax Return Tennessee Templateroller

CTEC 1040-QE-2355 2020 HRB Tax Group Inc.

Business tax deadline 2021 tn. Arizonas unemployment taxable wage base is 7000 for 2021 unchanged from 2020. The tax rate for new employers is 200 for 2021 unchanged from 2020. The DEADLINE for 2021 Tax Relief applications is April 5th 2022.

The Department of Revenue is extending the filing and payment deadline for Hall income tax returns and for certain taxpayers the franchise and excise tax return from April 15 2021 to May 17 2021. 1032 PM CDT June 7 2021 Updated. The redemption deadline is the amount of time the property owner has to pay the tax debt.

TN-2021-01 May 13 2021 Tennessee Victims of severe storms straight-line winds tornadoes and flooding that began March 25 2021 now have until August 2 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. 15 of the next year. Energy-related tax incentives can make home and business energy improvements more affordable.

1032 PM CDT June 7 2021 MEMPHIS Tenn. FEBRUARY 1 Your Receipt of Tax Schedule B. Businesscorporate law programs focus on how to establish buy sell manage and close businesses.

In most cases the tax lien has a redemption deadline and a certificate expiration date. Robertson County has a tax freeze program for individuals over the age of 65. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC.

In comparison tax rates in 2020 ranged from 005 to 642 for positive-rated employers and from 678 to 1285 for negative-rated employers. On April 23 2021 new market values for ad valorem tax purposes were mailed to property owners and also made available on-line. TN-2020-01 March 6 2020 Tennessee Victims of the severe storms tornadoes straight-line winds and flooding that began on March 3 2020 in Tennessee may qualify for tax relief from the Internal Revenue Service.

Tax lawyers need to understand laws at the federal state and local levels. Following the recent disaster declaration for individual assistance issued by the Federal. Quarterly estimated payments 15th day of the fourth sixth and ninth months of the current tax year and the 15th day of the first month of the next succeeding tax year if you have a combined tax.

April 15 Even though the tax filing deadline has been extended to May 17 2021 estimated taxes are still due on April 15 June 15. These are the Estimated Federal Tax due dates in 2021. The bill was signed into law by President Biden on March 30 2021.

Growth in Nashville-Davidson County continued to be strong particularly in the residential industrial and apartment property types. The President has declared that a major disaster occurred in the State of Tennessee. The House and Senate have passed bill HR 1799 PPP Extension Act of 2021 that extends the previous March 31 2021 PPP loan application deadline to June 30 2021.

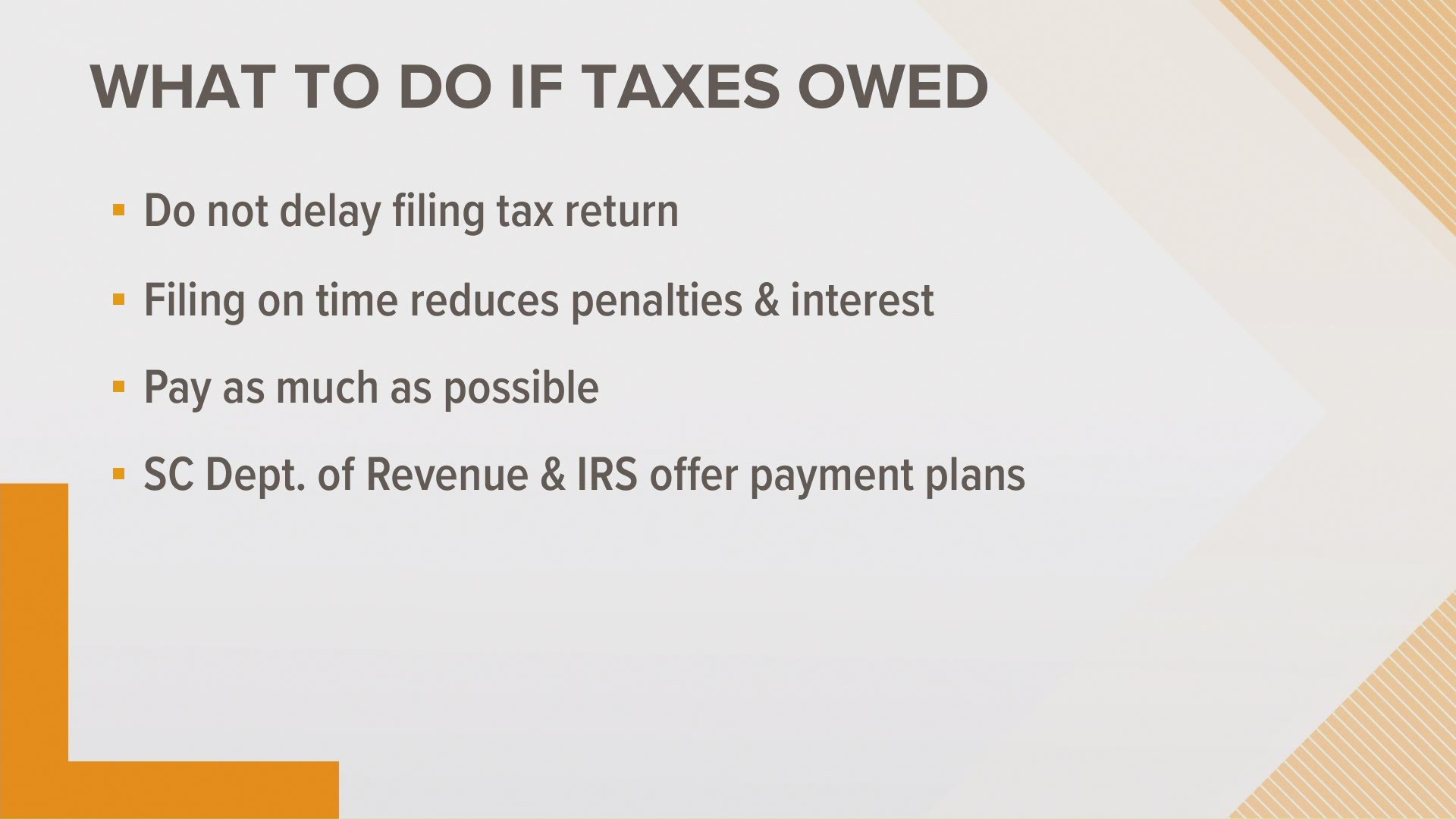

This extension follows an announcement from the Internal Revenue Service extending the deadline for federal individual income tax. Under the program qualifying homeowners age 65 and older can freeze the tax due on their property at the amount for the year they qualify even. If you missed the tax deadline but are due a refund there is no penalty.

All required information signatures and tax payments must be in the trustees office before close of business on April 5th. Tax law courses are relevant for law students who want to be corporate. MARCH 1 Your Deadline for Filing Return with Assessor.

Tax amnesty scheme Vivad se Vishwas is one of the most successful direct tax dispute resolution schemes which settled more than 148 lakh vexed cases and recovered 54 of. The Nashville Metropolitan Government has contracted with Tax Management Associates Inc TMA a professional consulting firm to assist in the audit and review of the tax schedules. The 2021 Reappraisal is completed.

Following the recent disaster declaration issued by the Federal Emergency Management. Prospective business lawyers study topics including. If not you have to get it to the post office by the end of their business day today May 17 2021 to send it offWhile the original filing and payment due date was April 15 the IRS pushed the deadline to May 17 to give individual filers tax preparers and the IRS itself more time to sort through the many changes affecting ones 2020 taxes from the.

The effective application deadline is May 31 2021. The Tax Freeze Act of 2007 permits local governments to implement the program and Metropolitan Nashville-Davidson County became the first jurisdiction in the state to establish a tax freeze program. Tax Filing and Payment Extension.

June 4 2021 Deadline Approaching for Revised Weight and Balance OpSpecs June 4 2021 NBAA Applauds Selection of Pioneering Garmin Autoland Technology for 2020 Collier Trophy June 4 2021 NBAA Thanks FAAs Bahrami For a Career Characterized by Thoughtful Effective Leadership. Expires January 31 2021. The 2021 tax freeze is based on 2020 income limited to no more than.

Selected businesses will be audited by TMA. Ranked in 2021 part of Best Law Schools. Small business tax prep File yourself or with a small business certified tax.

Have you filed your 2020 tax return. Shelby County Commissioners settle on a one cent property tax rate hike in a 7-5-1 vote. Annual 15th day of the 4th month following the close of your books and recordsFor business with a 11-1231 calendar year this tax is due on April 15th of the following year.

The certificate expiration date is the amount of time you have to.

Federal Income Tax Deadlines In 2021 Tax Deadline Income Tax Deadline Federal Income Tax

Irs And Many States Announce Tax Filing Extension For 2020 Returns

Tax2290 Com Taxexcise Com Is A Proud Member Of Tennessee Trucking Association No Need To Manually Fill In Tax Forms Doing Tax Forms Trucks Truck Driver

Which Form Should An Employer Use A W 2 Or A 1099 Nec Payroll Taxes Business Tax Accounting Services

Where S My Tennessee Tn Tax Refund Tn Income Tax Exemptions

Tax Returns Due May 17 Last Day To File Taxes Without Penalty Localmemphis Com

Form Bus428 Rv R00107 Download Printable Pdf Or Fill Online Business Tax Return Tennessee Templateroller

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Tennessee Tax Forms 2020 Printable State Tn Inc 250 Form And Tn Inc 250 Instructions

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

2020 Tax Deadline Extension What You Need To Know Taxact

Business Tax Timeline Annual Vs Quarterly Filing Synovus

Tax Returns Explained And The Cost Of Missing The Tax Return Deadline Advice For Small Businesses Ahead Of The Tax Return Self Assessment Income Tax Return

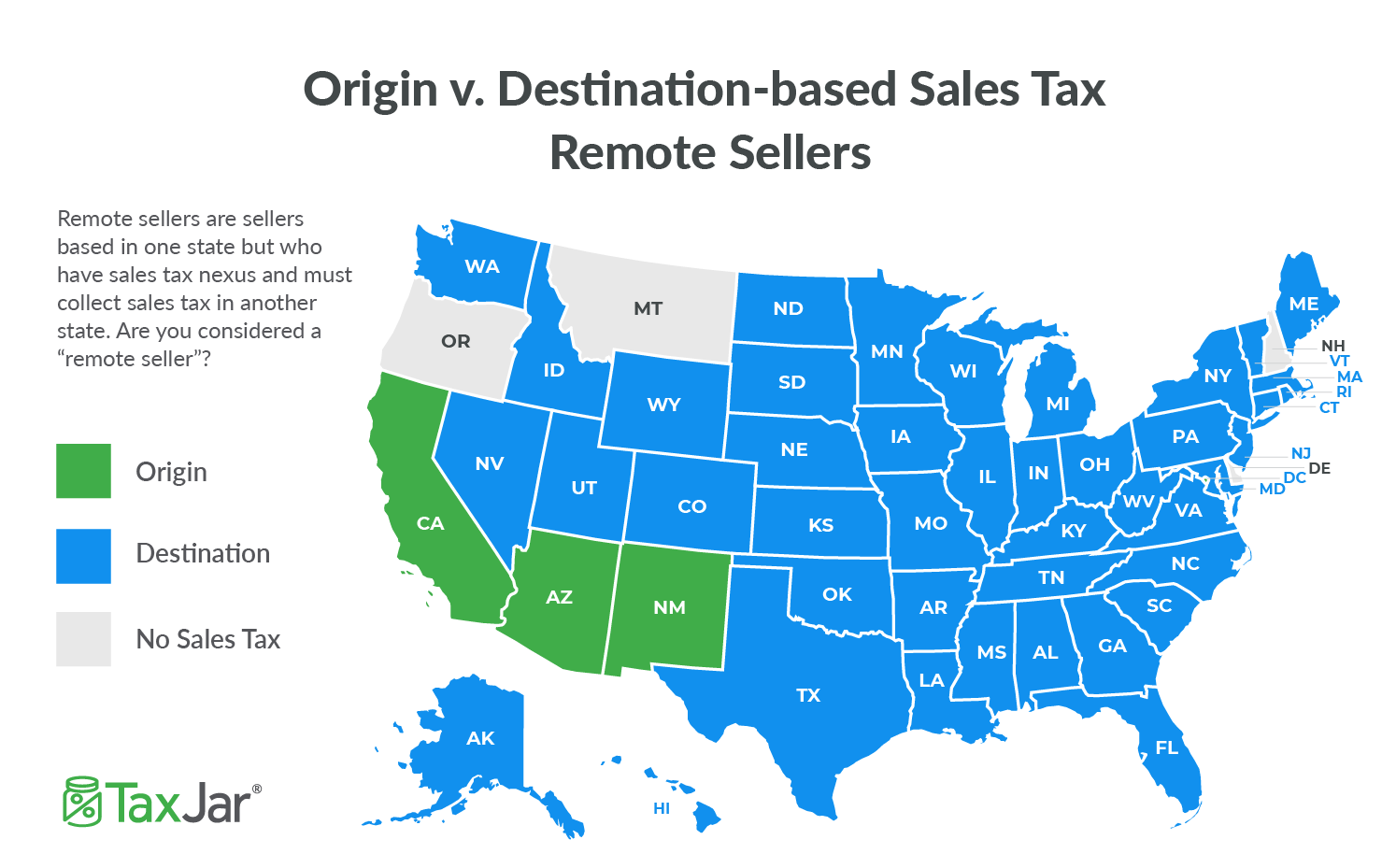

Origin Based And Destination Based Sales Tax Collection 101 Taxjar Blog

Impact America Free Tax Prep And Ways You Can Get Involved Choose901

Tn Dor Bus 415 2015 2021 Fill Out Tax Template Online Us Legal Forms

Tennessee Business Personal Information Nonprofit Tax Extensions

Historical Tennessee Tax Policy Information Ballotpedia

Post a Comment for "Business Tax Deadline 2021 Tn"