What Size Companies Are Affected By Ir35

There seems to be much confusion on the application of the IR35Off-payroll working administrative rules scheduled to apply from April 2020 where there are overseas aspects for example where the worker provided by a personal service company or similar entity PSC is based overseas or where the worker and PSC are in the UK. Off-payroll working rules change on 6 April 2021 and are applied differently.

Ir35 Information For Our Clients Addressing Your Most Frequently Asked Questions

When the off-payroll IR35 rules are extended to the private sector in April 2020 small companies will be excluded as things currently stand.

What size companies are affected by ir35. The new IR35 rules only apply to medium or large sized businesses in the private sector and all companies in the public sector. The government stated that the new IR35 rules will impact 170000 consultants 60000 end-users and generate additional tax revenue of 31billion between 2020 and 2024. We questioned which industries will be affected by the IR35 new legislation due to come into effect in April 2020 and what businesses and freelancers should be mindful of once the legislation is in.

From this date all public authorities and medium and large-sized clients will be responsible for deciding. The Intermediaries Legislation IR35 has been a thorn in the side of limited companies that provide professional services since 2000. 18 May 2021.

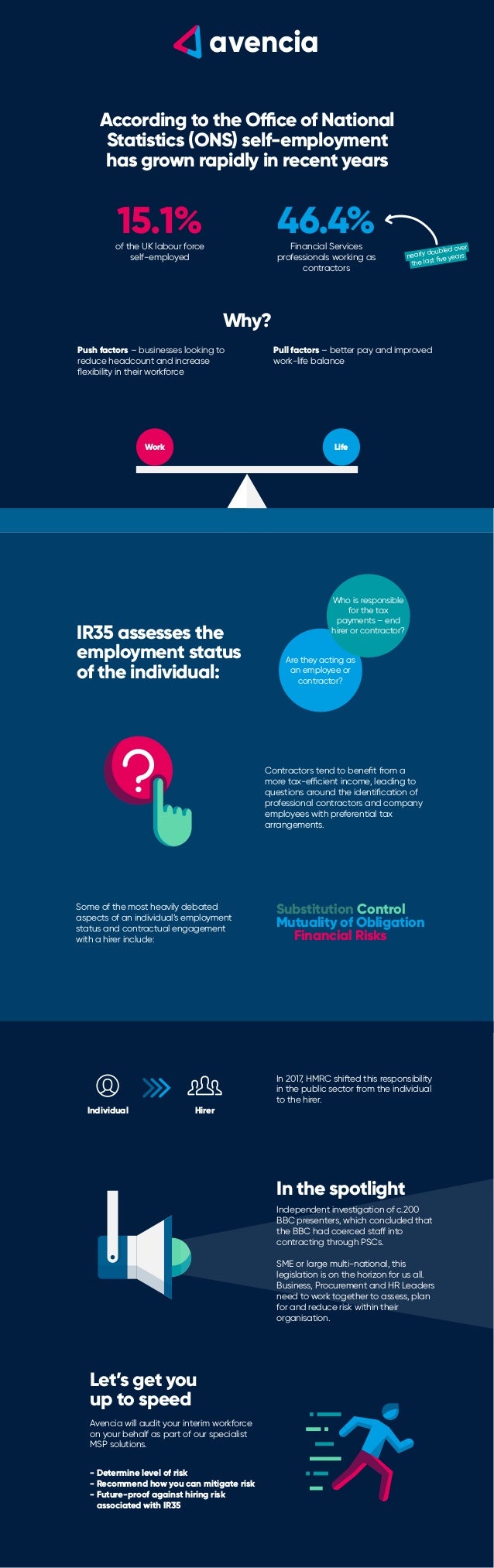

Proposed changes to IR35 legislation could mean thousands of contractors may pay more tax. Off-payroll IR35 the small company exemption problems lie ahead. There is an exemption for.

One of the biggest headaches is around tax with the fabled IR35 legislation being a particular worry. Industry experts give their take on impending IR35 legislation. The long and short of it.

Many contractor relationships will need to be reviewed to ensure compliance with IR35. Contractors should be aware that even small firms may come under the scrutiny of IR35 and HMRC and will likely be handled the same as medium or large companies. Here we look at what IR35 is and how to ensure that your company.

The guidance has been updated to reflect that the off-payroll working rules changed from 6 April 2021. There are many benefits to becoming a freelance contractor from flexible working hours to creating a healthier work-life balance. Under IR35 Chapter 8 of ITEPA 2003 the intermediary the contractors limited company is responsible for determining the employment status of its workers.

With the Governments consultation on contracting in the private sector now underway It is important for you to look at it and how you will be affected if the legislation comes into force from April 2019. The potential impact of these new rules should not be underestimated. However the exclusion itself may.

From April 2020 large and medium-sized businesses in the private sector will be bound by IR35 rules. What the new rules mean from April 2021 and the self-employed workers affected by legislation The private sector reform was due to take place in April last year but was delayed. Due to perceived widespread non-compliance with IR35 in 2017 the Government rolled out off-payroll working rules to cover all public sector organisations.

Medium and large sized private sector businesses hiring personal service company contractors are responsible for determining the IR35 status of their contractors as of April 2021. The Governments current consultation on off-payroll working in the private sector confirms that the public sector off-payroll working rules otherwise known as IR35 will be extended to medium and large sized private sector businesses from 6 April 2020. Information about a delay due to the coronavirus COVID-19.

What does this mean for your business. Home Resources Guides How does IR35 affect limited companies. The financial consequences if your work is caught by this tax rule are significant.

The only benefit that currently exists to working for a small firm is that you not be affected by the changes coming 6th April and will keep your ability to determine your IR35 status. 21 December 2019. Of course there are some challenges too.

Those workers who fall inside of IR35 are required to have PAYE and National Insurance Contributions NICs deducted at source from their income.

What Do Ir35 Changes Mean For Recruitment Agencies

Ir35 Addressing Our Clients Most Frequently Asked Questions

Ir35 2020 Thoughts From The Coal Face On The Fence Development

What Do Ir35 Changes Mean For Recruitment Agencies

Ir35 42 Of Contractors Might Leave Their Role We Love Salt Uk

Ir35 Reform April 2021 What It Means For Companies In The Usa Cxc Global

Amazon Com Ir35 Off Payroll Explained The Ultimate Guide To Ir35 And The Off Payroll Legislation For Hiring Firms Agencies And Contractors Ebook Chaplin Dave Gordon Keith Kindle Store

Navigating New Off Payroll To Stay On Course For Business Success

Ir35 Business Solutions Salt Leading Digital Recruitment Agency

Five Questions On Ir35 You Should Know The Answers To Michael Page

What The New Ir35 Off Payroll Regulations Mean For Private Sector Firms

Ir35 Calculator All Products Are Discounted Cheaper Than Retail Price Free Delivery Returns Off 60

Biggest Heist In Uk History Codename Ir35

Ir35 Disaster For Companies And Contractors Alike Will Hit Uk Industry

The Top 3 Ir35 Challenges To Overcome When Building An Automation Team Convedo Digital Experts

Ir35 Reform April 2021 What It Means For Companies In The Usa Cxc Global

Ir35 Changes Companies Start To Make Their Call Hudson Rpo

Post a Comment for "What Size Companies Are Affected By Ir35"