Can You Start A Business While On Ei

In early 2015 the Canada Employment Insurance Commission CEIC was advised by CRA that the taxpayer had applied for a business registration number while collecting EI. Besides if you have been looking for a job and you couldnt find any the next option you have is to start a business.

How To Fill Out Your Ei Internet Report Dutton Employment Law

So if you pay your dividends at that amount your accountant can roll over any additional funds into next year to save you from owing too much.

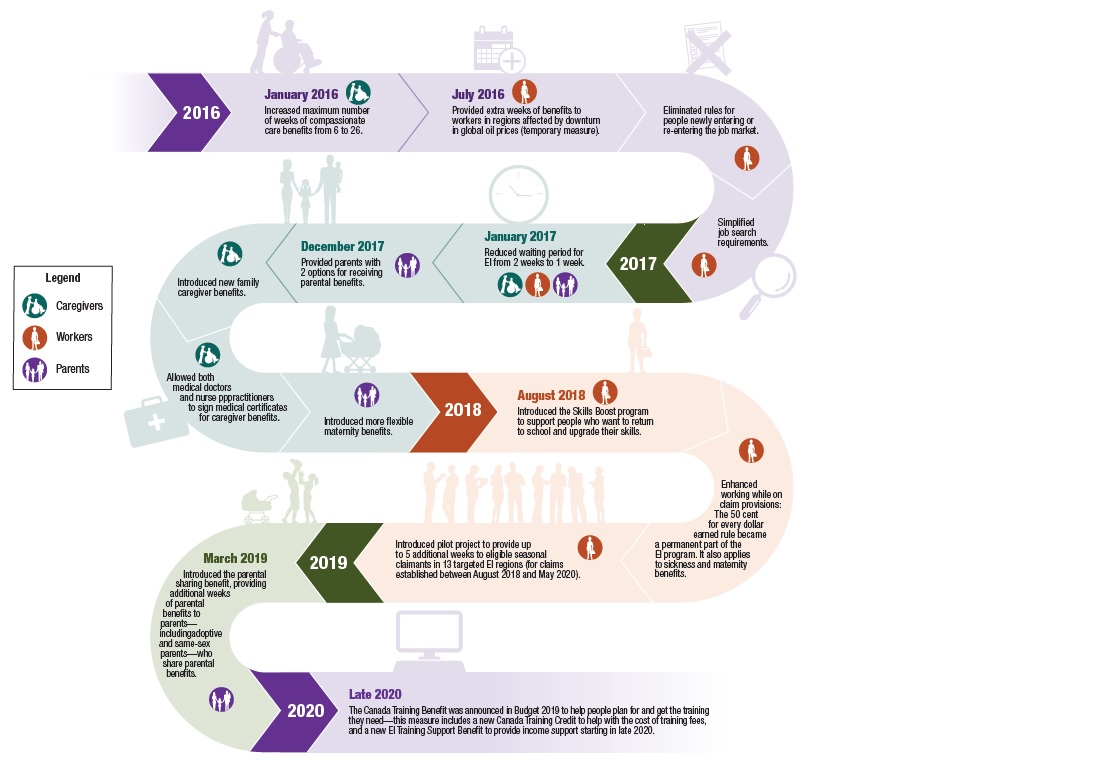

Can you start a business while on ei. You must continue to make an effort to find work and you cannot start your business until approval for SEA has been provided. Involved in running the business is considered selfemployed for EI purposes and any income attributable to selfemployment will affect the EI benefits. The 50 cents for every dollar earned rule becomes a permanent part of the Employment Insurance EI program.

The answer is simple and straight forward. This can be problematic for individuals who are employed while also being involved in the operations of a corporation in which they own shares. In early 2015 the Canada Employment Insurance Commission CEIC was advised by CRA that the taxpayer had applied for a business registration number while collecting EI.

File your EI reports 4. If the individual loses his or her job and. By QuickBooks Canada Team.

Starting A Business While Receiving Social Assistance. Stay in Canada 5. This can be problematic for individuals who are employed while also being involved in the operations of a corporation in which they own shares.

Unfortunately aside from a few special circumstances you will need some equity in order to start a business -contrary to the idea of many that all you need is a good idea. With Working While on Claim you can keep receiving part of your EI benefits and all earnings from your job. The Working While on Claim rules now apply to sickness and maternity benefits.

You must always declare on your bi-weekly report all your earnings from your work or any self-employment earnings your business generates for you while you are receiving EI special benefits. You have to be eligible for Employment Insurance to apply. Summer Company.

This program allows people to collect unemployment compensation while they work on their business. Hed like to start his own business during this year off and has a former associate who would like to partner with him. A taxpayer can operate a business while collecting EI benefits where his business activity is to such a minor extent that a person would not normally rely on that business activity as a principal means of livelihood.

However a shareholder who is also involved in running the business is considered self-employed for EI purposes and any income attributable to self-employment will affect the EI benefits. If you are starting your own business ensure that your earnings wont disrupt your benefits. As of August 12 2018.

If you receive government benefits tax credits or Employment Insurance you have to meet certain criteria. Or-Had a EI benefit ended within the last. As an independent worker engaged in a business you may be able to register for access to EI special benefits for self-employed people.

Yes you can start a business while on Employment Insurance in Canada. Working while on EI 3. And there are some programs for starting small businesses while on EI.

Eligibility You are eligible if you are unemployed and-Have a current EI Claim. If you are collecting EI due to the loss of a job you may work and continue to receive. You can make up to 150 month to yourself while on EI.

Programs are usually province-specific as is the linked example from Alberta. If you are an independent worker including a professional who also works in insurable employment usually under a contract of service as an employee you may be eligible for Employment Insurance EI benefits. Thats true whether the income is from an outside source or from self-employment.

Applicants must not be eligible for other self. Follow directions from Service Canada staff. Start your job search 2.

You also arent obliged to accept work outside your field of expertise or paying substantially below. In order to remain eligible for EI while your business plan for SEA is being considered you must be able to prove that you are still unemployed and available for work. Its still possible to lay the groundwork for your own business while youre unemployed and receiving benefits.

The Department of Labor has a program called the Self Employment Assistance program SEA. Working while on EI. Students in Ontario aged 15 to 29 can receive small-business grants ie awards of up to 3000 as well as hands-on entrepreneur training and support to run their own summer businesses.

A few states have initiatives encouraging individuals on unemployment to start a business. I would chat with an accountant first before you register your company. Technically while on EI you must be ready willing and searching for work.

Ive read some articles on how this works for starting your own business while on EI but I havent read anything specifically about a business that hed own 50 of. While on EI You may be able to work andor your business may continue to generate income while you are receiving EI benefits. Keep in mind however that any income earned while youre on unemployment will reduce your benefits.

You can start a business while collecting unemployment but it may affect the amount of your weekly benefit and could be impacted by the time you need to spend searching for a full-time job. But you must be aware of the implications of starting a business while on Employment Insurance EI in Canada. A taxpayer can operate a business while collecting EI benefits where his business activity is to such a minor extent that a person would not normally rely on that business activity as a principal means of livelihood.

How To Complete Your Employment Insurance Paper Report Canada Ca

How To Complete Your Employment Insurance Paper Report Canada Ca

How To Fill Out Your Ei Internet Report Dutton Employment Law

Employment Insurance Recent Improvements And Overview Canada Ca

Emotional Intelligence Why Ei Can Be More Important Than Iq

Https Www Sd35 Bc Ca Wp Content Uploads Sites 2 2015 08 Ei Faq Pdf

How To Fill Out Your Ei Internet Report Dutton Employment Law

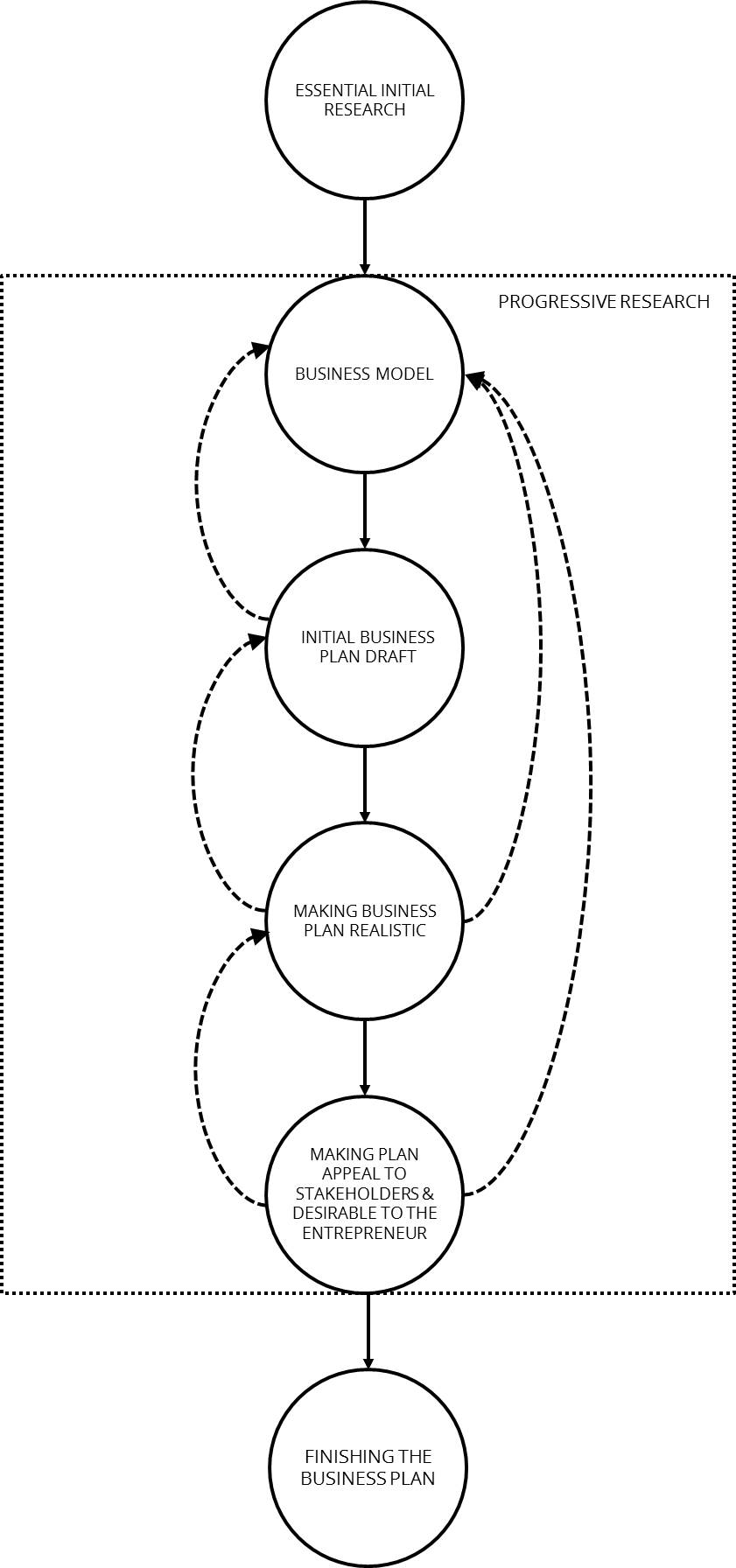

Chapter 5 Business Planning Entrepreneurship And Innovation Toolkit

Severance Pay And Employment Insurance Toronto Employment Lawyers

Can I Get Ei If I Quit My Job Steps To Justice

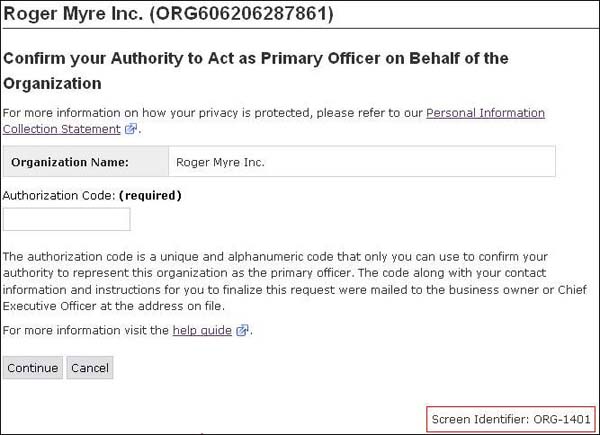

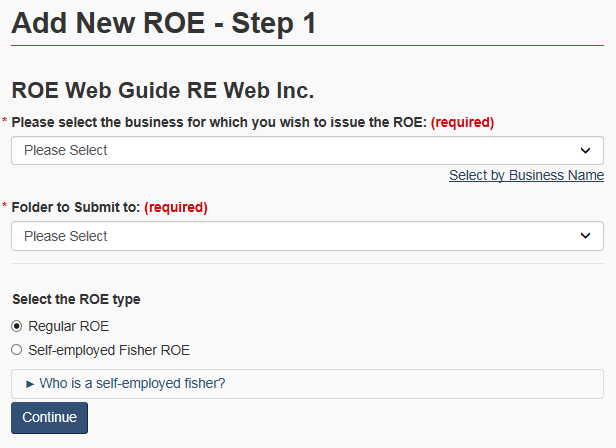

Roe Web Registration And Account Management Canada Ca

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/GQZXWIHVMREOFN4XVT3UWUCTTU.jpg)

How To Apply For Ei And Other Covid 19 Emergency Government Income Supports The Globe And Mail

What Happens If Employer Fails To Issue Roe On Time Dutton Employment Law

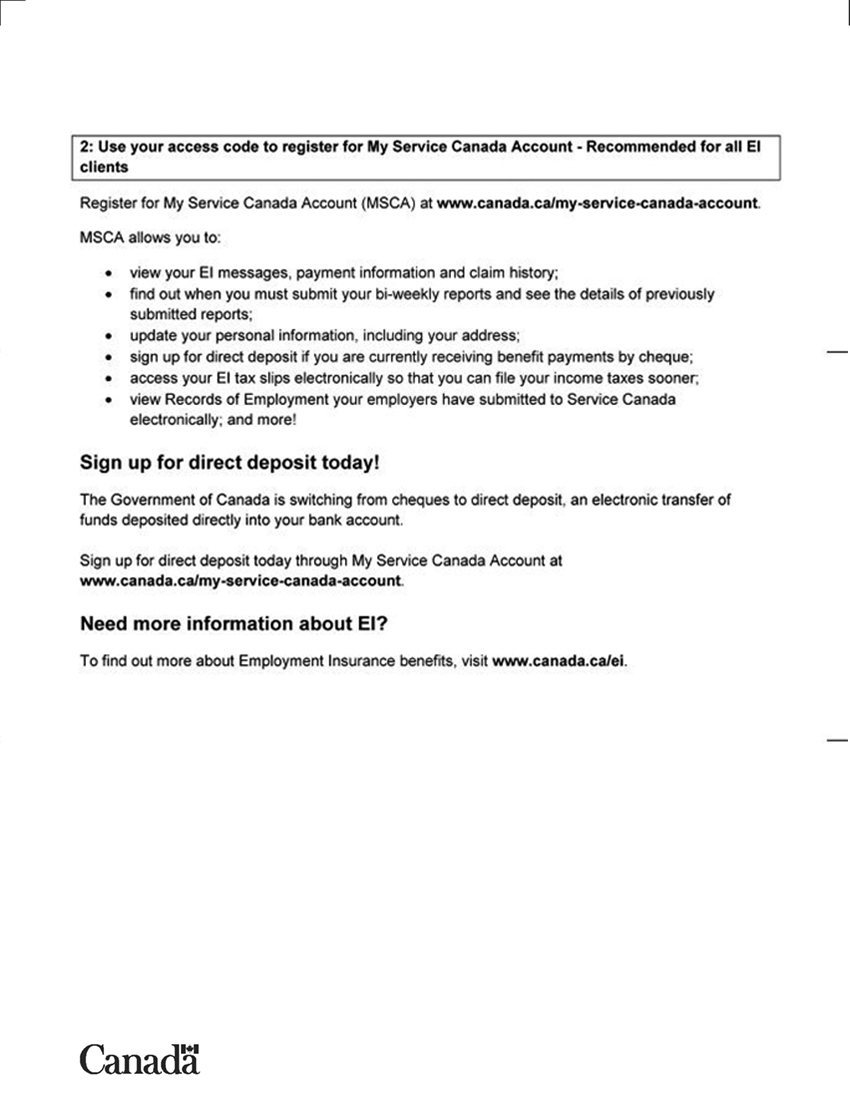

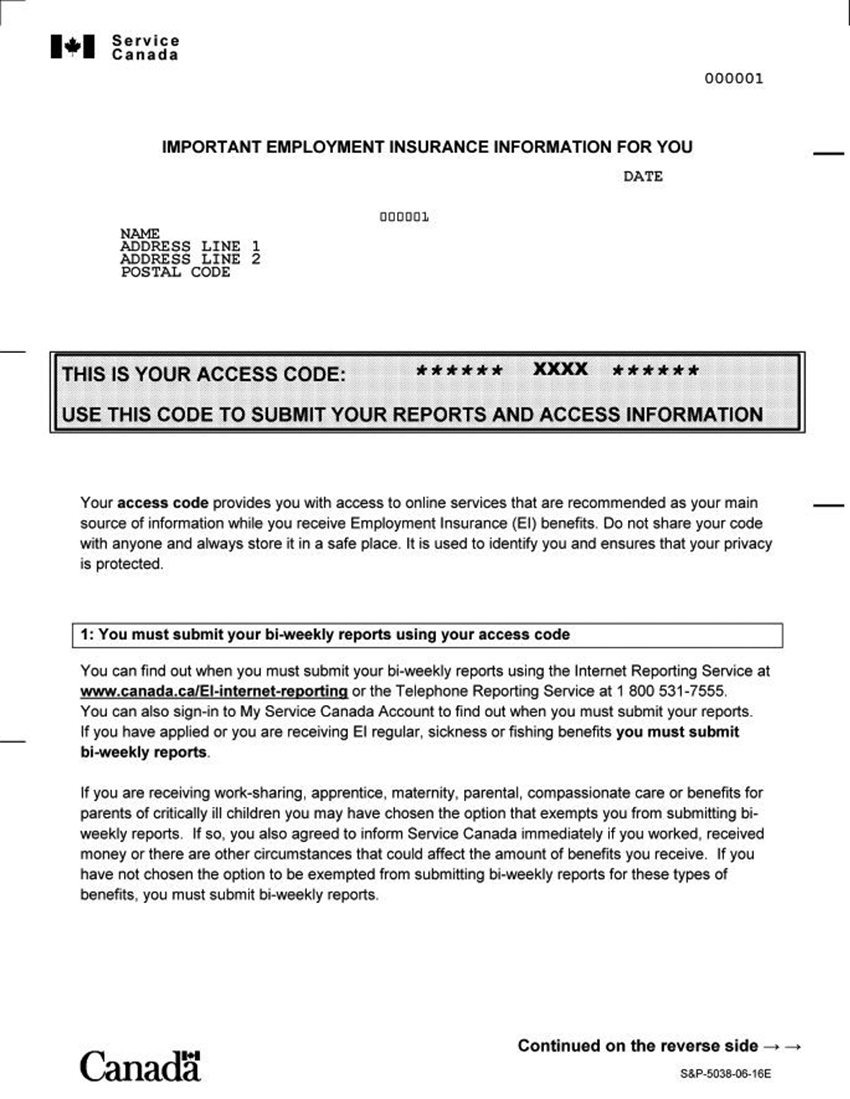

Employment Insurance Ei Benefit Statement Canada Ca

Employment Insurance Ei Benefit Statement Canada Ca

Can You Collect Employment Insurance If You Are Terminated Without Cause

Coronavirus Can A Person Work Part Time And Still Collect Ui Benefits

Post a Comment for "Can You Start A Business While On Ei"