Business Definition Zero Rate

You can claim input tax credits on the GSTHST that you pay to make the supplies. The rate of interest that banks charge businesses for borrowing money.

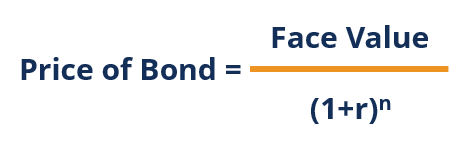

Zero Coupon Bond Definition How It Works Formula

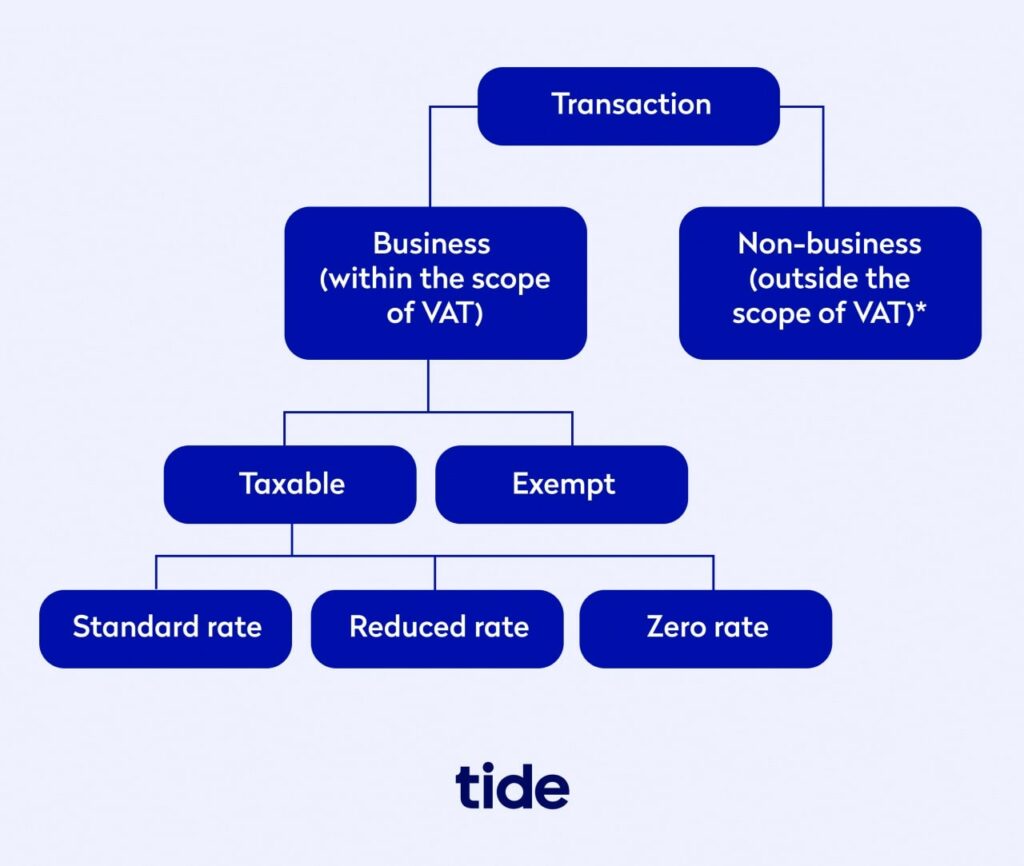

Zero-rated supplies fall under a separate category but theyre actually taxable supplies where the rate of the GSTHST is 0.

:max_bytes(150000):strip_icc()/fredgraph1-5c4216c046e0fb0001b804e0.png)

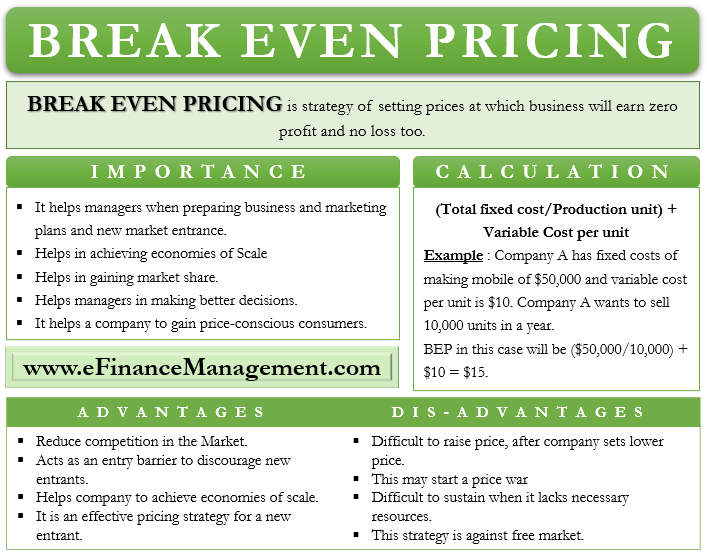

Business definition zero rate. At the end of the period the interest and principal are paid to the investor as no intermediate payments would need to be made. What is Zero Rate Certificate Tax Definition- A certificate that a customer gives to a supplier to enable the supplier to zero-rate the construction of a building a supply of land or a supply of fuel and power. Almost all countries apply preferential rates to some goods and services making them either zero rated or exempt.

Zero-rated supplies typically relate to basic necessities of life. Foreign-based pleasure craft are defined as those pleasure craft in New Zealand as temporary imports under Customs legislation. Consumable stores are goods that passengers and crew on board intend to consume and those necessary to operate or maintain the pleasure craft including fuel and lubricants but excluding.

It has begun again in the United States since March 15 2020. On a set of numbers for comparing temperature in degrees Celsius. What is the Rate of Absorption.

For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. The zero-rating applies to the final provisioning of consumable stores. Zero rate Zero-rated means that the goods are still VAT -taxable but the rate of VAT you must charge your customers is 0.

The term is used in relation to VAT where the rate of tax which is in principle levied but at a rate of 0 so that in effect no tax is payable but will result in refunds of input tax credits. This rate is based on the historical relationship between the amount of cost usually. So you theoretically charge the tax but at a zero rate.

Zero Rate A zero-coupon interest rate is the rate of interest earned on an investment that is made over a given period horizon. You still have to record them in your VAT accounts and report them on your. To rate at a VAT level of zero If a builder is given the entire contract he can zero-rate the VAT and therefore need not charge you VAT.

To rate at a VAT level of zero If a builder is given the entire contract he can zero-rate the VAT and therefore need not charge you VAT. Zero interest-rate policy is a macroeconomic concept describing conditions with a very low nominal interest rate such as those in contemporary Japan and December 2008 through December 2015 in the United States. An amount of money.

The rate of absorption is the predetermined rate at which overhead costs are charged to cost objects such as products services or customersThe rate of absorption drives the amount of overhead costs that are capitalized into the balance sheet of a business. 123 rows Zero-rating is the practice of providing Internet access without financial cost under. This reduces the price of a good.

The Federal Reserve cut the Fed Funds rate to nearly zero due to the ongoing COVID-19 pandemic and weakening economy.

:max_bytes(150000):strip_icc()/inflation_color2-216537dd3aeb4365b991b67790765e4f.png)

Inflation Definition Formula How To Calculate

Zero Coupon Bond Definition How It Works Formula

Opportunity Cost Meaning Importance Calculation And More

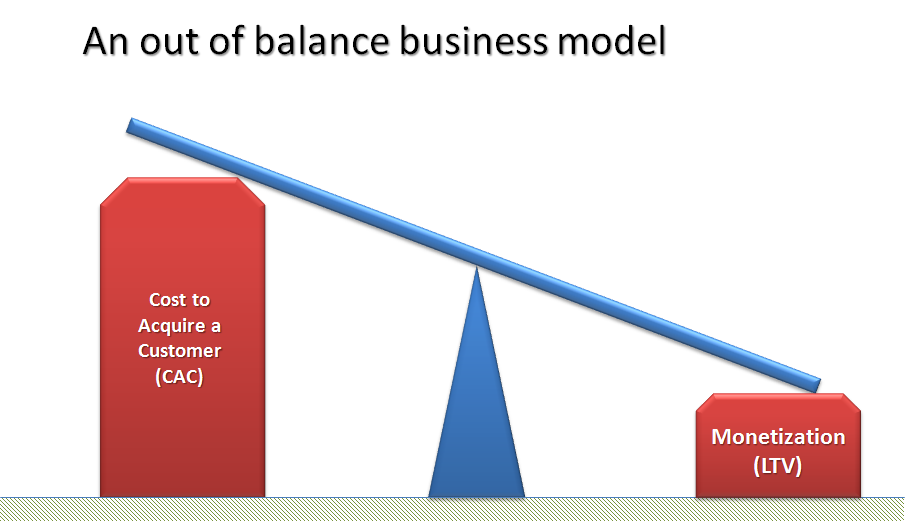

Startup Killer The Cost Of Customer Acquisition For Entrepreneurs

/fredgraph1-5c4216c046e0fb0001b804e0.png)

Low Interest Rate Environment Definition

Discount Rate Definition Types And Examples Issues

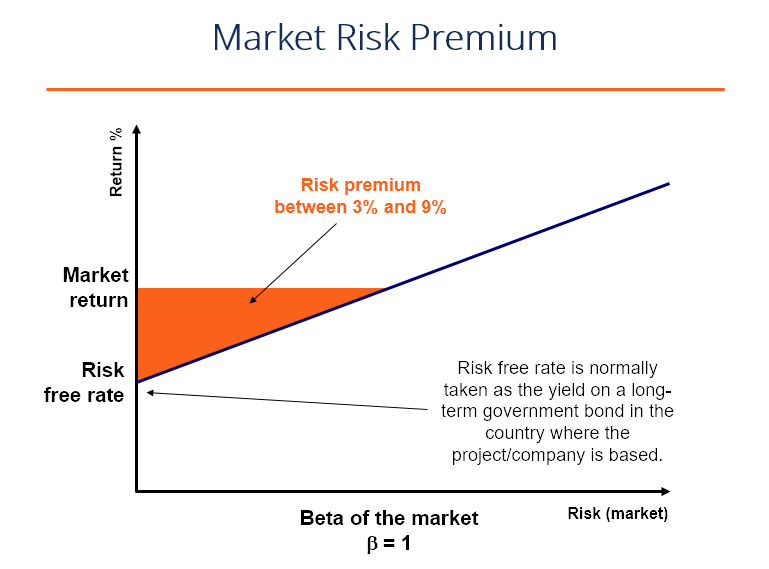

Market Risk Premium Definition Formula And Explanation

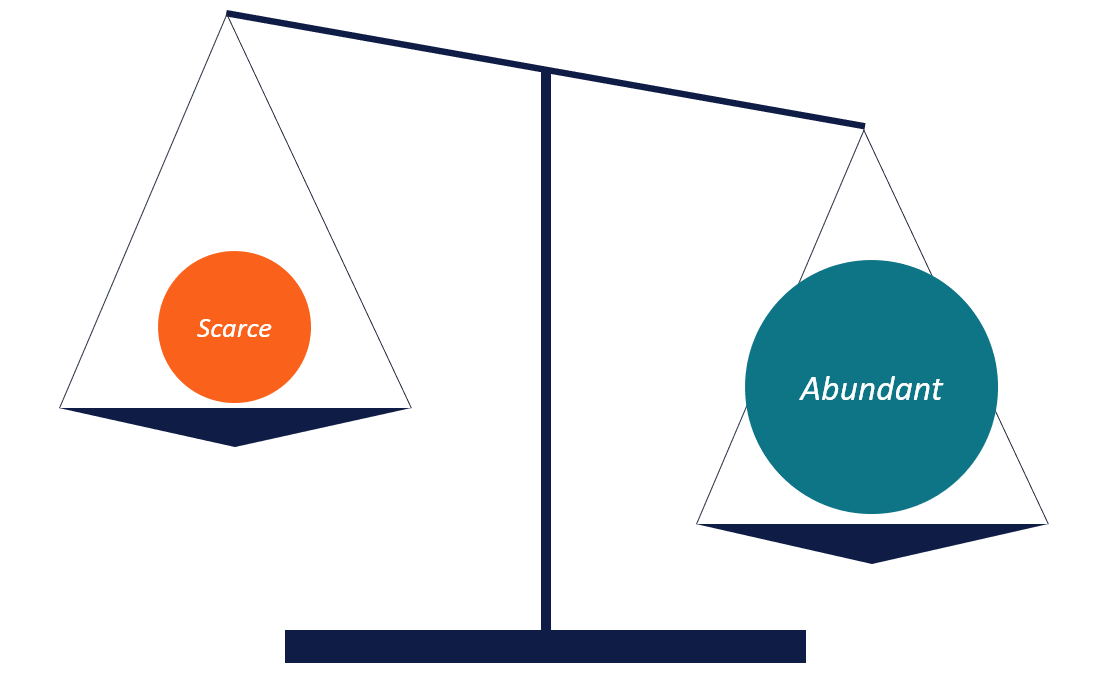

Scarcity Definition The Basics And Examples In Business

Breakeven Pricing Meaning Importance Advantages And More Efm

:max_bytes(150000):strip_icc()/fredgraph1-5c4216c046e0fb0001b804e0.png)

Low Interest Rate Environment Definition

Vat Exemption Everything You Need To Know Tide Business

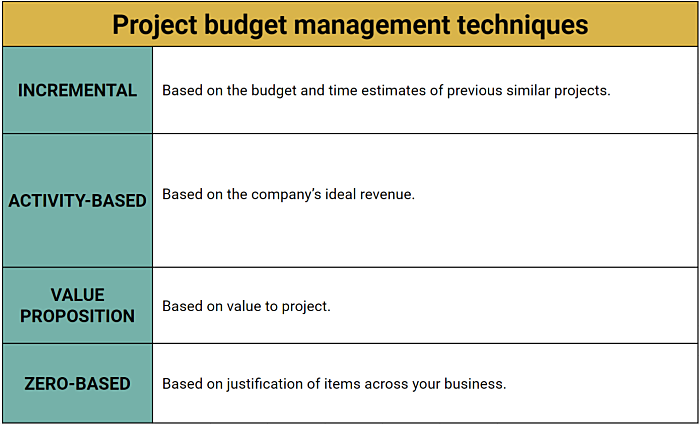

Project Cost Management Everything You Need To Know Clockify Blog

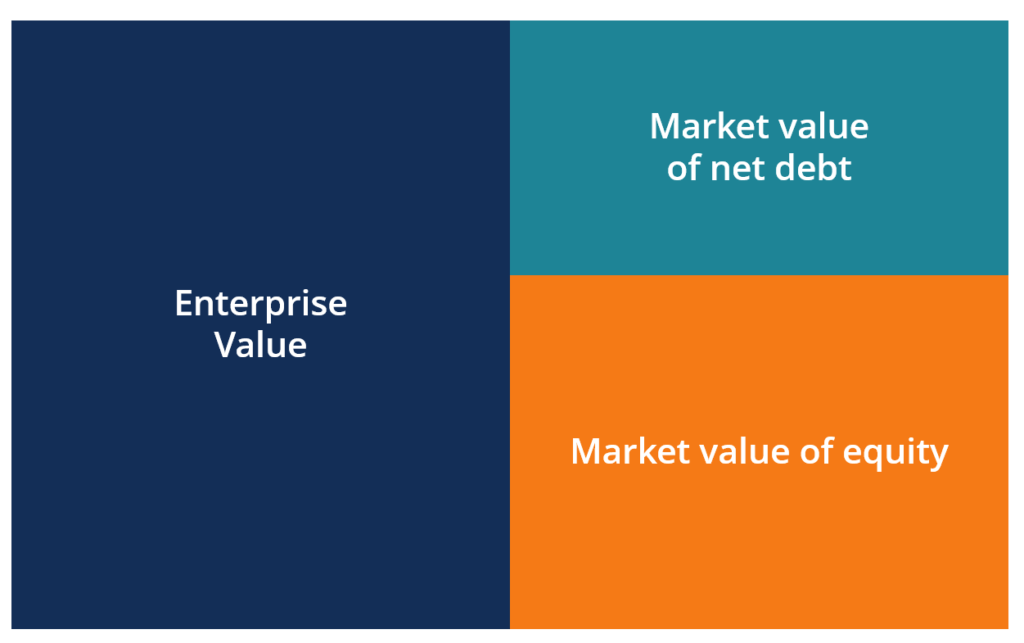

Enterprise Value Ev Formula Definition And Examples Of Ev

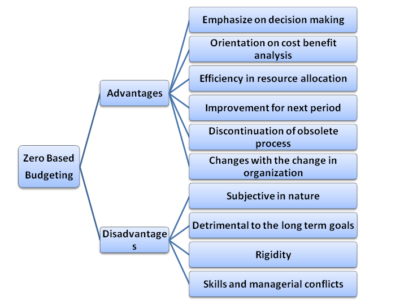

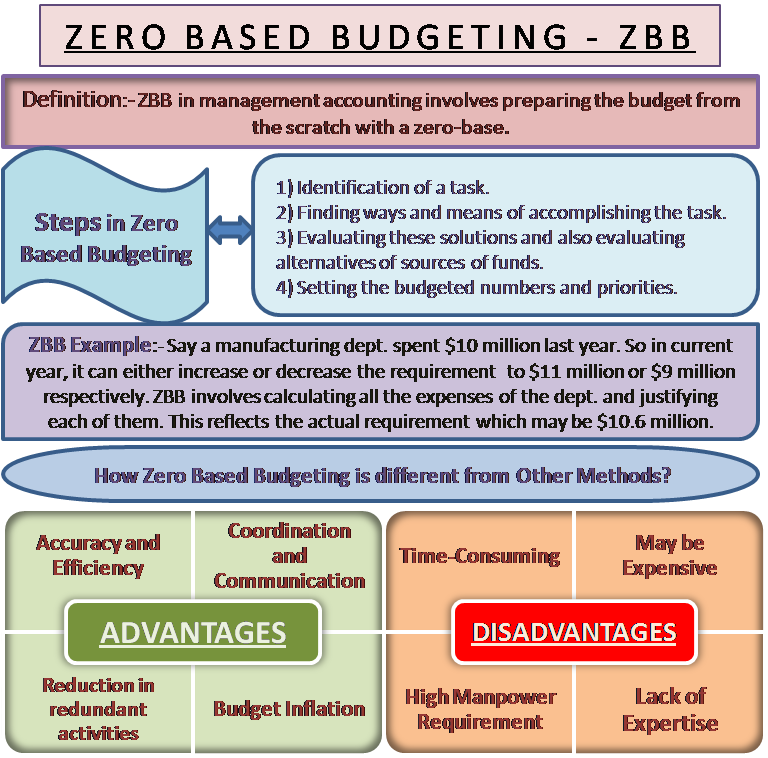

Zero Based Budgeting Meaning Steps Advantage Disadvantage

Zero Based Budgeting Meaning Steps Advantage Disadvantage

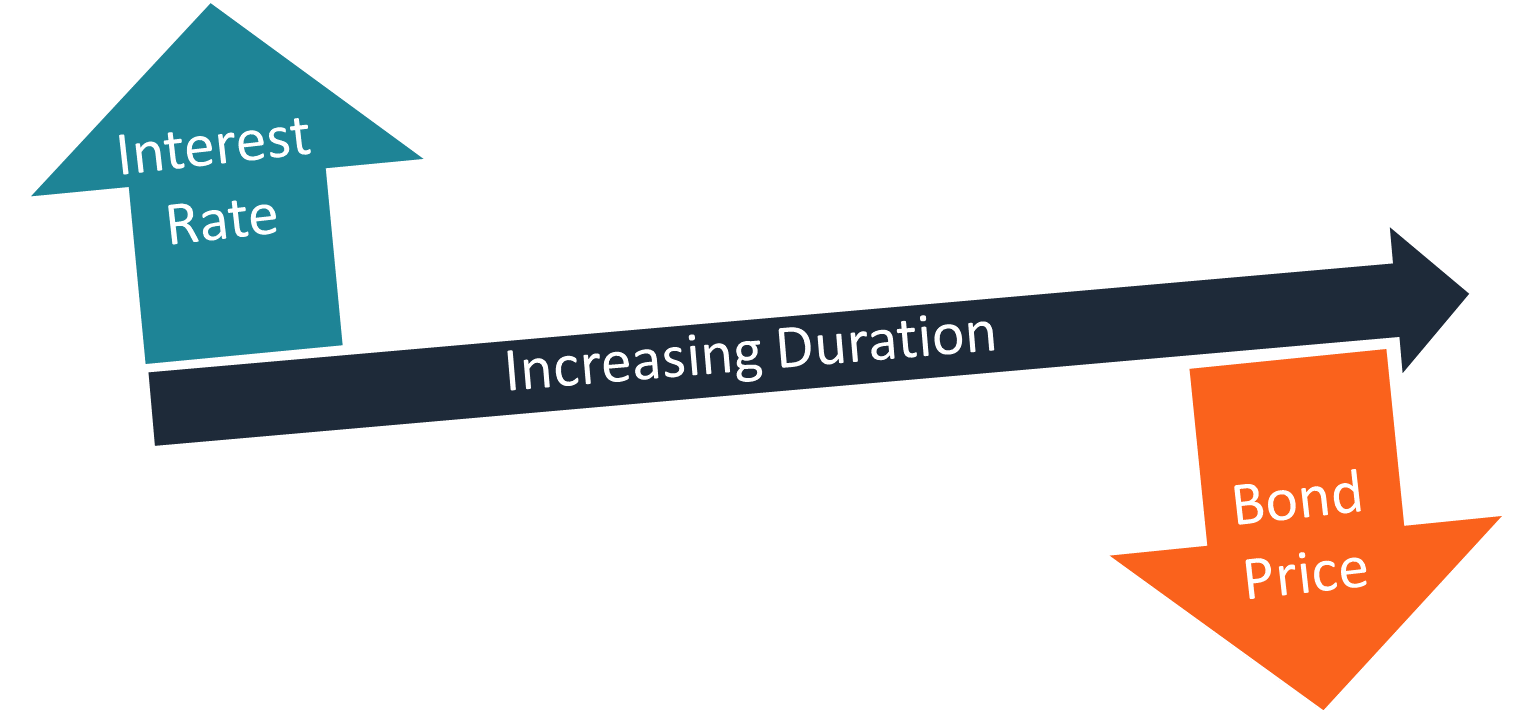

Duration Definition Types Macaulay Modified Effective

/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

:max_bytes(150000):strip_icc()/Apple10K-97033366f9974bb6990acbe1b3e2c277.jpg)

Post a Comment for "Business Definition Zero Rate"