Llc Tax Filing Deadline 2021 Virginia

Businesses may use Form 1120 or request a six-month extension by filing Form 7004 and submitting a deposit for the amount of estimated tax owed. Multiple-member LLC returns filing partnership returns on Form 1065.

Business Tax Timeline Annual Vs Quarterly Filing Synovus

Ralph Northam announced Friday that the state Department of Taxation is extending the original May 1.

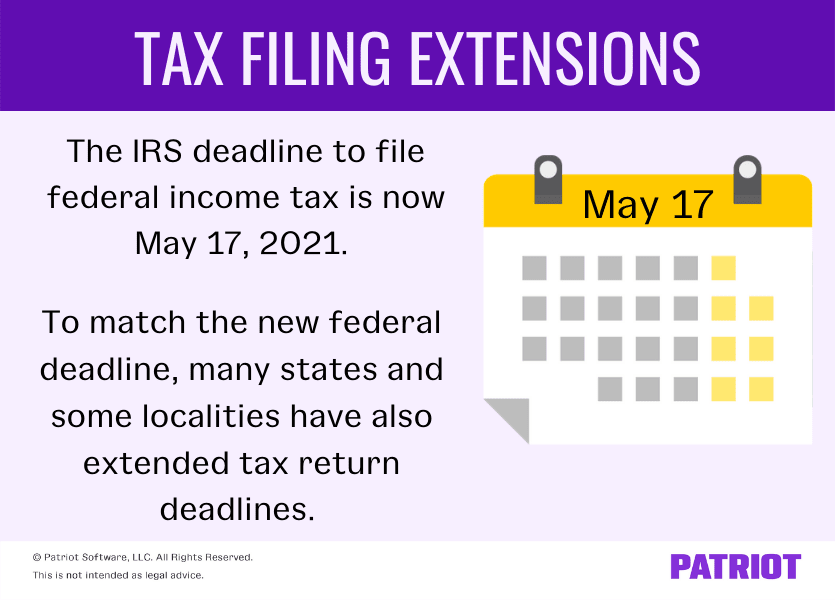

Llc tax filing deadline 2021 virginia. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. Returns are due the 15th day of the 4th month after the close of your fiscal year. According to Tax Bulletin 21-5 the Virginia Department of Taxation will waive interest and penalties on individual income tax payments due for Taxable Year 2020 that are made in full by the extended due date of May 17 2021.

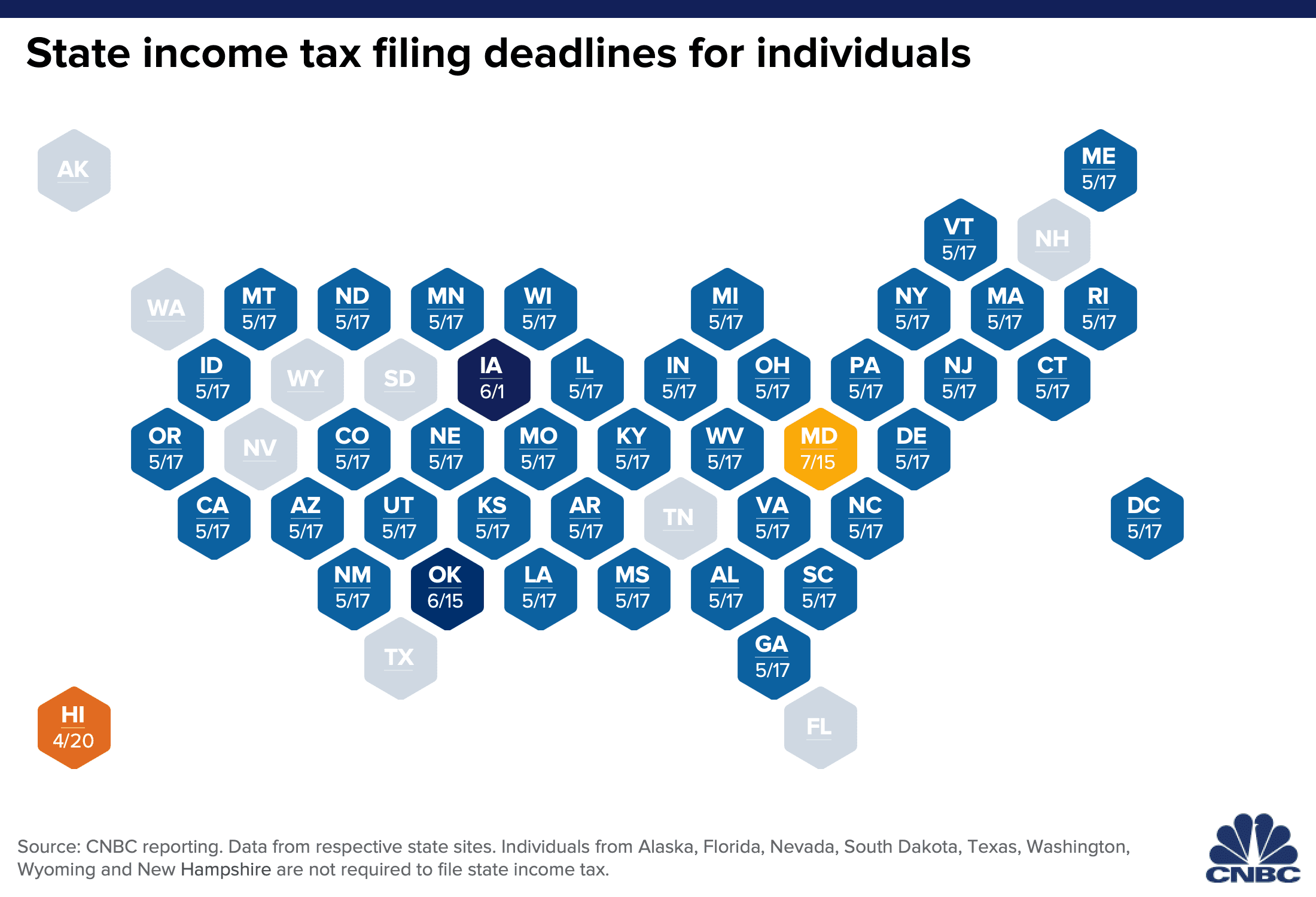

Check with your states Department of Revenue for additional deadlines. All forms for Virginia Limited Liability Companies are eligible for online filing. Corporation Income Tax Return the deadline being April 15 2021 for corporations operating on a calendar year the extended deadline is October 15 2021.

Failure to file the report and pay the required franchise taxes will result in a penalty of 20000 plus 15 interest per month on tax and penalty. For C Corps not using a calendar year the filing deadline is the 15th day of the fourth month following the end of the corporations fiscal year. Virginia is giving taxpayers a few more weeks to file their state income tax returns.

See How to File and Pay below for payment options. On April 15 annual federal taxes are due and typically also in each state. Virginia Limited Liability Companies.

The first quarterly estimated tax payment of the year is also due on this date. C Corps file IRS Form 1120 US. Tips for Filing Season.

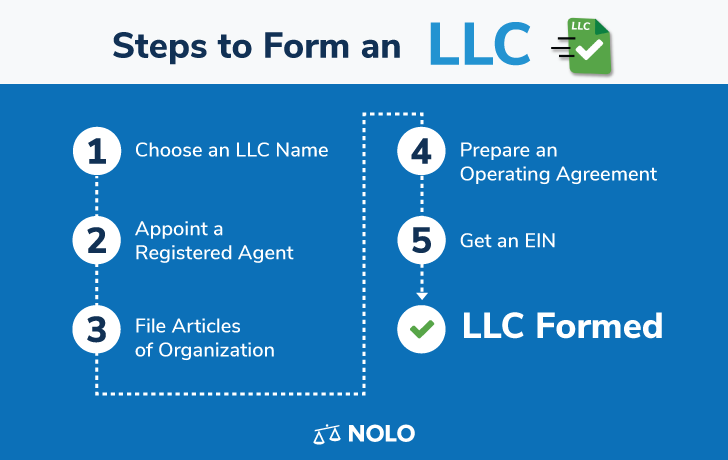

Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021. Corporations are required to file and pay all annual income tax returns estimated payments and extension payments electronically. A Limited Liability Company LLC is an entity created by state statute.

If you file Form 8868 for your June 15 2021 deadline your new due date will be December 15 2021. Here are key tax filing dates to remember for 2021. Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021.

However the filing deadline for 2020 individual income tax returns has been extended to Monday May 17 2021. When you file Form 8868 your organization can receive an automatic extension of up to six months. For more information about filing your return this year see Avoid Pandemic Paper Delays.

If the due date falls on a Saturday Sunday or holiday you have. 8043678037 To purchase Virginia Package X copies of annual forms complete and mail the Package X order form. Generally states follow federal guidelines for tax due dates.

The individual income tax filing and payment deadline in Virginia is extended to Monday May 17 2021. The number of the form relates to the applicable statute in Title 131 of the Code of Virginia. Knowing the Virginia LLC tax rules will keep a company in good standing with the law.

Partnership tax returns on Form 1065. Annual Report Filing Fees. You must apply for a tax extension no later than your typical tax deadline.

Quarterly tax due dates. On March 19 2021 Governor Northam announced that Virginia would move the Taxable Year 2020 individual income tax filing and payment deadline for calendar year filers from May 1 2021. When forming an LLC or limited liability company there are certain steps that need to be taken on a continuous basis in order to keep the business compliant with the lawThe steps will also give the owners of the company limited liability.

Sole proprietorship and single-member LLC tax returns on Schedule C with the owners personal tax return. It will also make handling taxes easier. Companies have until April 15 2021 to submit corporate tax returns for income received in 2020.

Its important to remember that nonprofits can only file one extension per year. S corporation returns on Form 1120 S. Schedule K-1s for partners in partnerships LLC members and S corporation shareholders on their personal tax returns.

Visit the Clerks Information System CIS to file business forms online. IMPORTANT INFORMATION REGARDING CERTAIN FILING AND PAYMENT DEADLINES. Virginia Department of Taxation.

Taxpayers have until June 30 2021 to make 2020 IRA contributions. If you need to order forms call Customer Services. Certain deadlines falling on or after February 27 2021 and before June 30 2021 are postponed through June 30 2021 including the deadlines for filing individual income tax returns and making payments of tax.

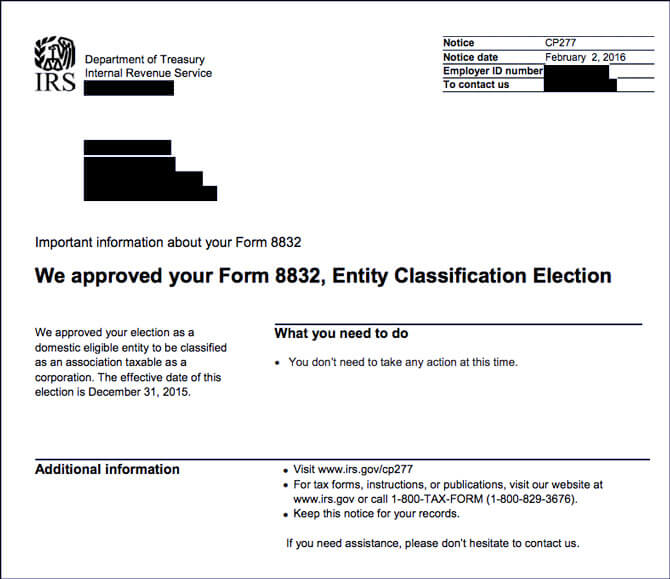

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. NEW INDIVIDUAL INCOME TAX FILING AND PAYMENT DEADLINE. All active Domestic Corporation Annual Reports and Franchise Taxes for the prior year are due annually on or before March 1st and are required to be filed online.

The New U S Tax Deadlines For 2020 Covid 19 Bench Accounting

Tax Preparer Accountant Business Card Zazzle Com In 2021 Tax Preparation Successful Home Business High Quality Business Cards

Irs And Many States Announce Tax Filing Extension For 2020 Returns

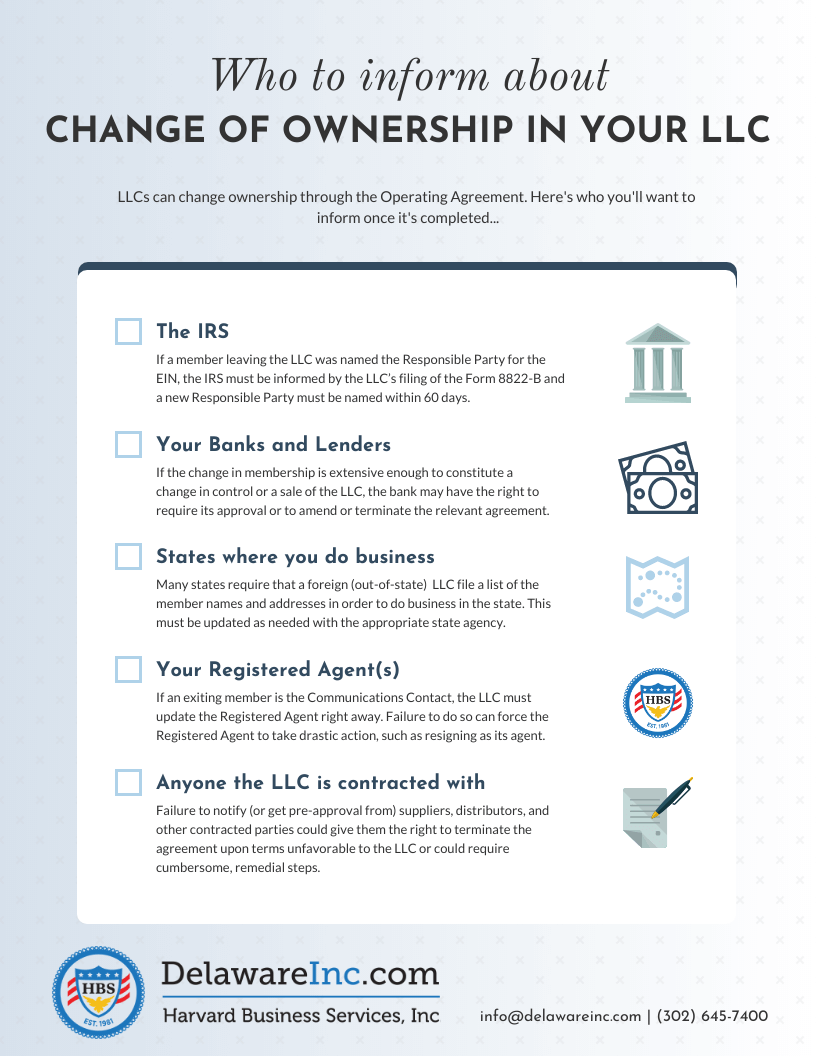

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

What Business Owners Need To Know About Filing Taxes In 2021

Everything You Need To Know About Filing Taxes In Multiple States Forbes Advisor

Llc In Virginia How To Start An Llc In Virginia Nolo

Llc Taxed As C Corp Form 8832 Advantages Disadvantages Llc University

Start An Llc In Pennsylvania 37 Nw Registered Agent

Irs And Many States Announce Tax Filing Extension For 2020 Returns

When Are Taxes Due For An Llc Legalzoom Com

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Federal And State Tax Filing Deadlines Extended

2021 Taxes A Comprehensive Guide To Filing Money

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

How To File An Extension For Taxes Form 4868 H R Block

Do I Need To File A Tax Return For An Llc With No Activity Legalzoom Com

Post a Comment for "Llc Tax Filing Deadline 2021 Virginia"