Business Tax Id Number Hawaii

Select your business type - Select your type of business in our easy-to-use online tool. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately.

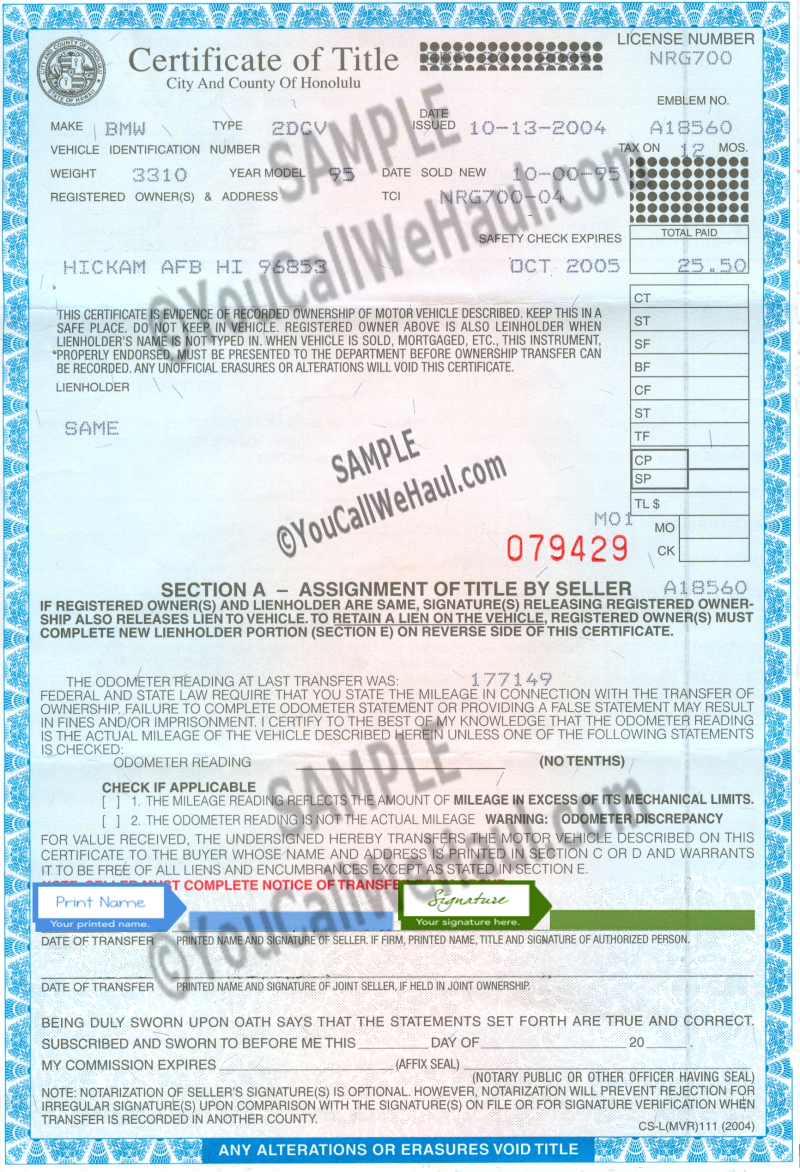

How To Transfer Hawaii Title And Instructions For Filling Out Your Title

Three steps to obtain your Hawaii Small Business Tax ID EIN 1.

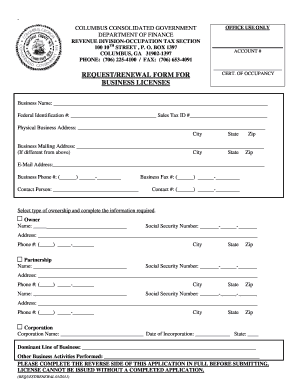

Business tax id number hawaii. Every business needs its own Tax Id Number. See a full list of all available functions on the site. Many of our registration forms are available for filing online.

You may apply for an EIN in various ways and now you may apply online. By visiting an office you can. The Business Action Center has offices in Honolulu Maui and Hawaiʻi counties.

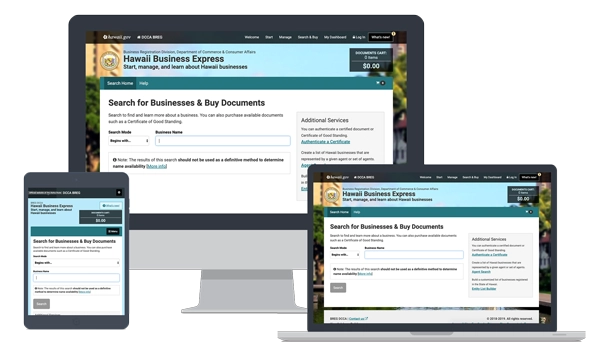

Register a business entity trade name trademark or submit other filings with the Department of Commerce Consumer Affairs Business Registration Division. For business registration assistance please email bregdccahawaii. Hawaii Tax ID Number How to get a Hawaii tax ID Number Even small businesses need and can benefit from a Hawaii Tax ID Number.

Every new business is required to have its own State IDHawaii tax ID number depending on the particular facts of your business. Find out more here or ask your lawyer bookkeeper or accountant to do this for you. Businesses operating in Hawaii are required to.

Hawaii Business Express is a state website that lets new businesses register with multiple agencies online. Hawaii State Legislature Website. Filing online can result in quicker review times and allows filers to check the status of their filings view filing deadlines purchase documents and more.

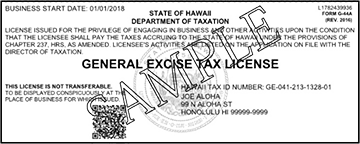

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on. It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. Corporations and LLCs as well as partnerships and independent contractors are required to have it but sole proprietors need it to use instead of a social security number.

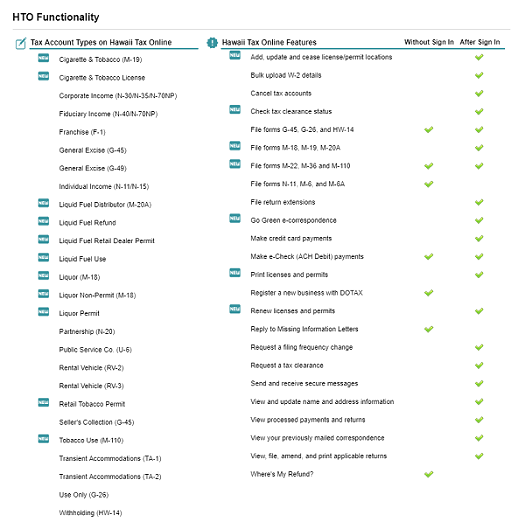

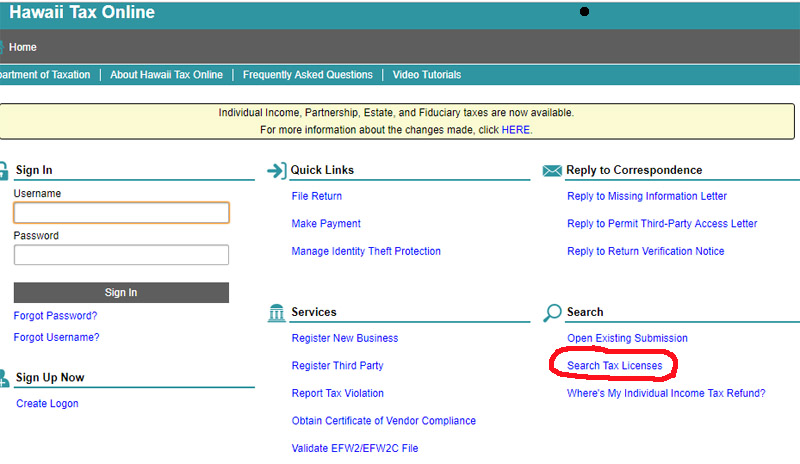

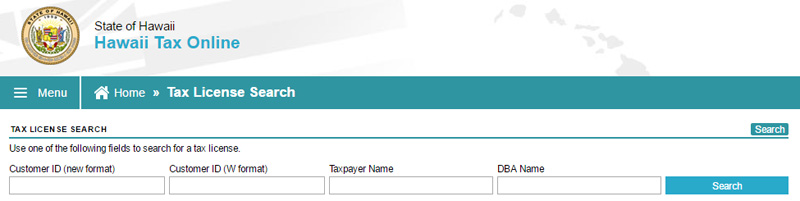

Instead we have the GET which is assessed on all business activities. To get a federal Tax Id Number state Tax Id Number or sellers number click here. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation.

Hawaii does not have a sales tax. Department of Commerce and Consumer Affairs. 0 transactions this year.

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. There are several different ones. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes payroll taxes and withhold taxes from employee wages.

Get help with applying for a general excise tax GET license from the Department of Taxation and receive information on how to apply for a federal employer identification number. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. 3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format.

Once the federal government issues you a tax identification number you will have to get a state Tax Id Number from Hawaii as well. Here are some advantages. 10 additional per document.

Enter your business information - Using our simple form fill out your businesss background and contact information. Then there is a Federal Tax ID Number a Business Tax Registration. Most documents are available for 3.

As the search functions for licensee and business status is. It helps the IRS identify your business for tax and filing purposes. One of several steps most businesses will need when starting a business in Hawaii is to register for an Employer Identification Number EIN and Hawaii state tax ID numbers.

A sellers permit also called a sales tax ID or a state employer Number ID for employee tax withholding. W99999999-01 Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. An EIN Number stands for Employer Identification Number and it will be issued by the IRS to your Hawaii LLC.

A Hawaii tax id number can be one of two state tax ID numbers. Federal Tax ID Number. This website will allow consumers to check out businesses individuals or licensed professionals that you intend to hire or do business with.

An EIN is to your Hawaii LLC what a Social Security Number is to a person. Having an EIN for your Hawaii LLC allows you to open a separate bank account under the LLCs name apply for certain licenses and. Generally businesses need an EIN.

Hawaii Tax IDs that were issued prior to the modernization project begin with the letter W and are followed by 10 digits. 11 rows Licensing Information. 750 electronic or printed Certified Copies.

Https Dotax Ehawaii Gov Efile Html Geins Pdf

Tax Id Numbers A Simple Guide Bench Accounting

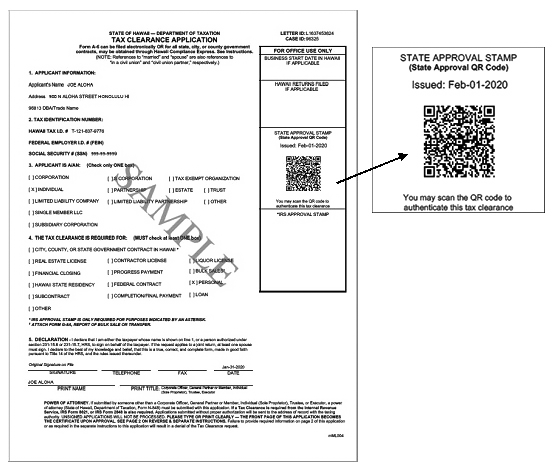

Tax Clearance Certificates Department Of Taxation

What S New To Hawaii Tax Online Department Of Taxation

Https Dotax Ehawaii Gov Efile Html Geins Pdf

Hawaii Ge Tax The 10 Most Frequently Asked Questions

Incorporate In Hawaii Do Business The Right Way

Https Dotax Ehawaii Gov Efile Html Geins Pdf

Ein Tax Id Number How To Apply For A Federal Ein

Https Dotax Ehawaii Gov Efile Html Geins Pdf

How To Get A Resale Certificate In Hawaii Startingyourbusiness Com

Licensing Information Department Of Taxation

Business License Template Fill Out And Sign Printable Pdf Template Signnow

Https Files Hawaii Gov Tax Forms 2020 G45ins Pdf

State To Change Id Card Driver S License Process Honolulu Star Advertiser

Post a Comment for "Business Tax Id Number Hawaii"