Business Risk Ki Definition

As such it is common for businesses to identify risks on a regular basis in order to find ways to avoid or reduce future losses. The risk is unavoidable in nature.

7 Steps In Privacy Risk Management Data Privacy Manager

Due to such risk the firm will not generate enough profit to meet out its day to day expenses.

Business risk ki definition. It also enables an integrated response to multiple risks and facilitates a more informed risk-based decision. The definition of business risk is a bad possibility such as constraints failures obstacles losses that may arise in the future due to efforts to carry out the business carried out at this time. Key Risk Indicators KRIs are useful tools for business lines managers senior management and Boards to help monitor the level of risk taking in an activity or an organisation.

In simple words we can say business risk means a chance of incurring losses or less profit than expected. Business risk refers to the basic viability of a businessthe question of whether a company will be able to make sufficient sales and generate sufficient revenues to cover its. Even though a businessman must be brave to take risks it does not mean that business people still have to keep measuring and carefully considering.

These factors cannot be controlled by the businessmen and these can result in a decline in profit or can also lead to a loss. Business Risk management is a subset of risk management used to evaluate the business risks involved if any changes occur in the business operations systems and process. However it can also be due to changes in the financial laws of a.

One reason for the development of such situations might be the wrong decision making in part of the senior level managers of a company. Effective risk management means attempting to control as much as possible future outcomes by acting proactively rather than reactively. Business risk affects holders of stocks and bonds since a firm may be unable to pay dividends and interest.

The business risk generates from the overall operation of a company. For example a risk that a company might fail to improve sales reduce costs or. It identifies prioritizes and addresses the risk to minimize penalties from unexpected incidents by keeping them on track.

A business risk is the potential for losses related to a business. Business risk can be defined as uncertainties or unexpected events which are beyond control. These put business entities in a position where they are not able to give adequate returns to its investors and stakeholders.

In business risk means that a companys or an organizations plans may not turn out as originally planned or that it may not meet its target or achieve its goals. Risks surround everything that a business big or small does. Business risk is greatest for firms in cyclical or relatively new industries.

The risk that a business will experience a period of poor earnings and resultant failure. Business Risk is the probability of earning a comparatively low profit or even suffer losses because of changes in the market conditions customer demands government regulations and economic environment of business. Business risk refers to the anticipation that the firm may earn lower than expected profits or even suffer losses because of the uncertainties inherent in the business such as competition change in customer tastes and preferences input cost change in government policies and so forth.

Risk management encompasses the identification analysis and response to risk factors that form part of the life of a business Business Life Cycle The business life cycle is the progression of a business in phases over time and is most commonly divided into five stages. Business risk is the exposure a company or organization has to factor s that will lower its profits or lead it to fail. To business lines managers they may help to signal a change in the level of risk exposure associated with specific processes and activities.

Anything that threatens a companys ability to achieve its financial goals. In an operational risk context a risk indicator commonly known as a key risk indicator or KRI is a metric that provides information on the level of exposure to a given operational risk which the. Business risk is an event circumstance or condition that may result in an organization failing to achieve its objectives or adversely affect its strategy.

Sabsa Executive Summary The Sabsa Institute

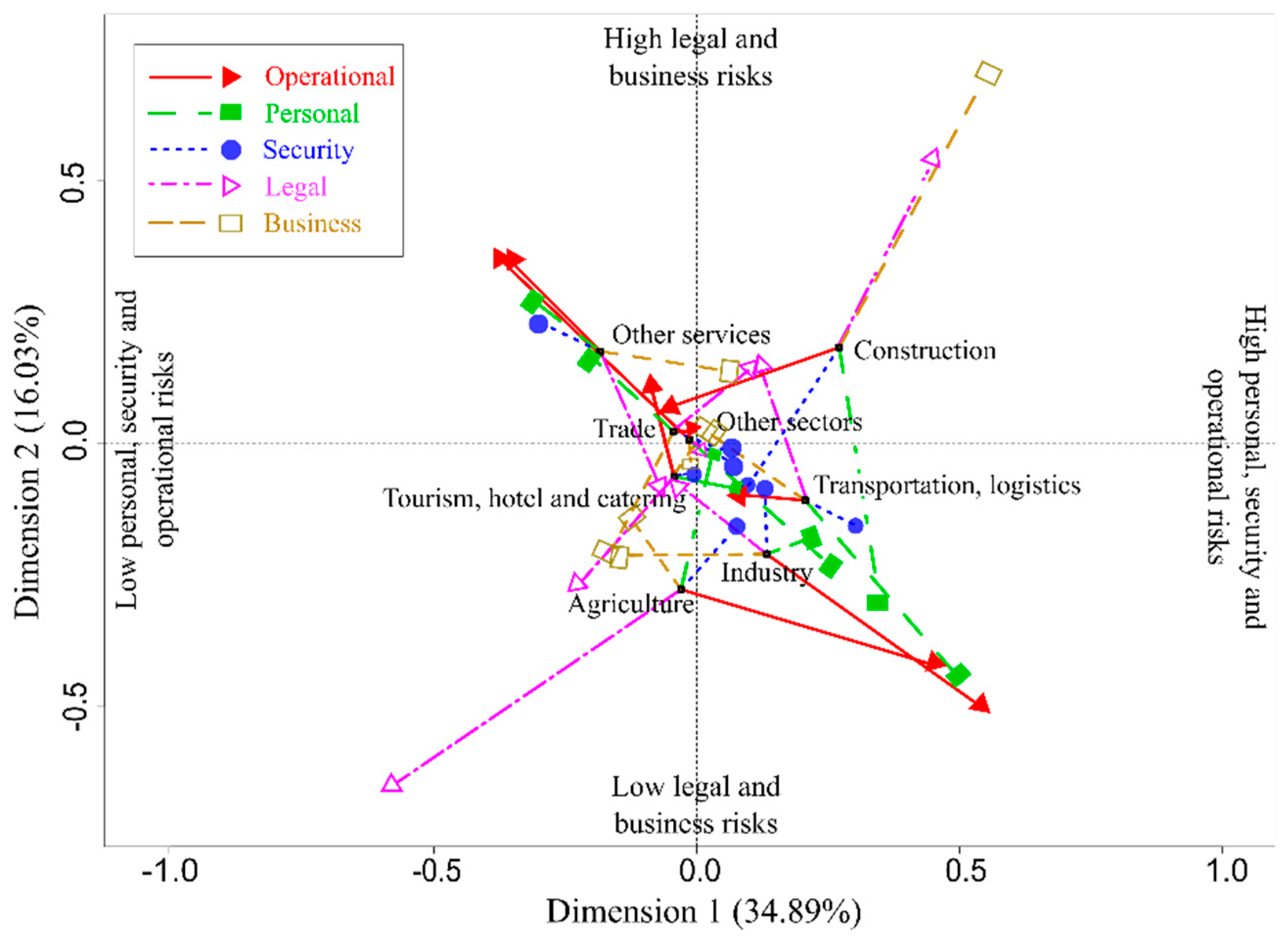

Sustainability Free Full Text The Assessment Of Non Financial Risk Sources Of Smes In The V4 Countries And Serbia Html

Best Business Strategy Models And Practices Powerpoint Templates Slidesalad Business Strategy How To Plan Strategy Map

Overview Of Risk And Issue Management Tutorial Simplilearn

Business Impact Analysis Template Fresh Business Impact Analysis Template Risk Management Risk Matrix Risk Analysis

Risk Management Treasury Prism

Overview Of Risk And Issue Management Tutorial Simplilearn

Financial Risks And Its Types Simplilearn Financial Risk Manager Business Process Management Risk Management

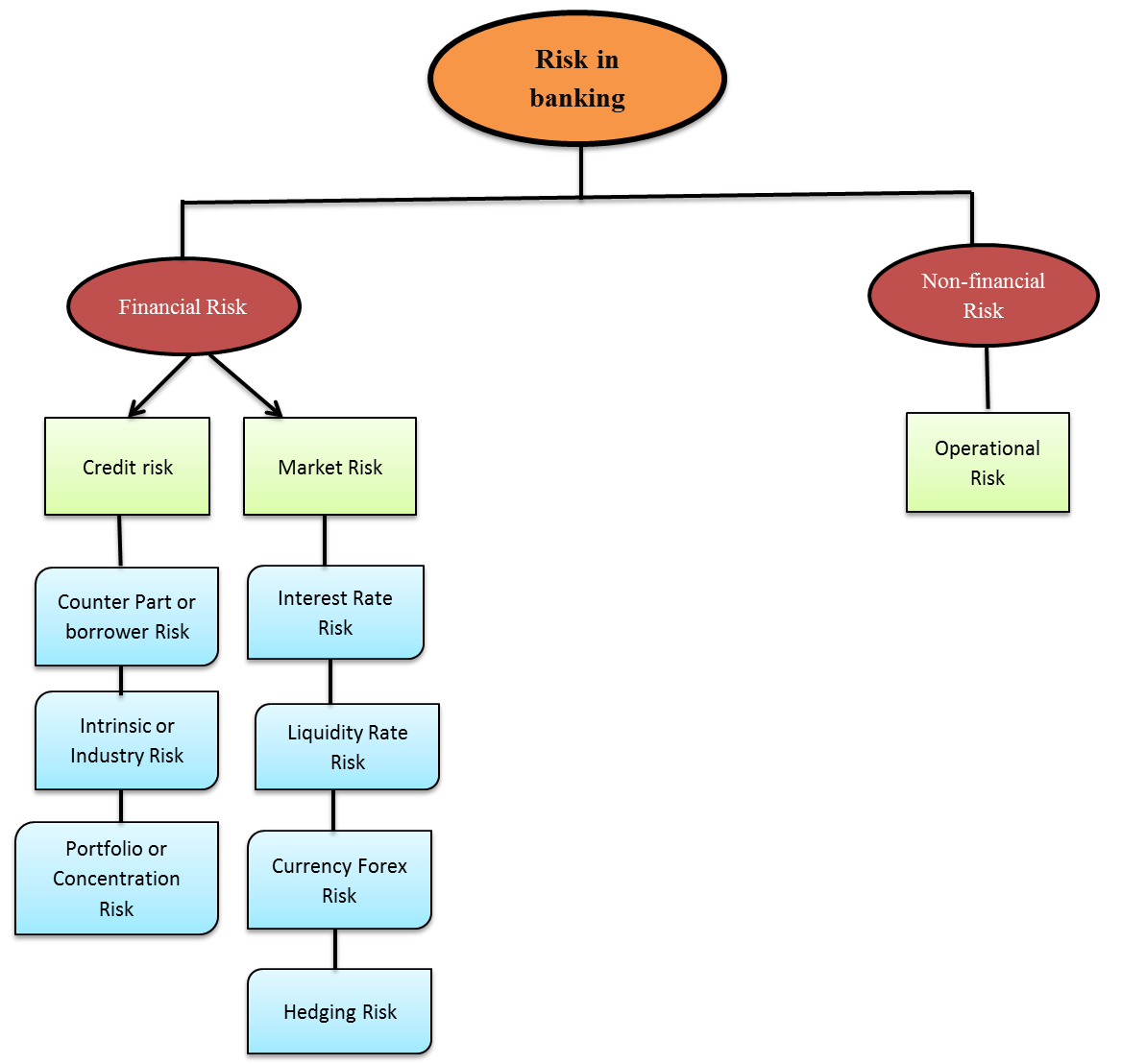

Risk Management In Banks Introducing Awesome Theory

Overview Of Risk And Issue Management Tutorial Simplilearn

Enisa The Risk Management Process According To Iso Standard 13335 Project Risk Management Corporate Risk Management Risk Management

16 Best Risk Management Books Updated In 2020 Risk Academy Blog

Pin By Peter Moore On Risk Management Risk Management Project Management Project Risk Management

7 Steps In Privacy Risk Management Data Privacy Manager

Illustrates Where Risk Management Occurs In The Vee Development Model Risk Management Planning Begins In The Systems Risk Management Business Risk Management

Pdf Operational Risk Management

Management Plan Of Business In 2021 Essay Writing Persuasive Essays How To Plan

Risk And How To Use A Risk Matrix Youtube

Post a Comment for "Business Risk Ki Definition"